Case Study

Case Study

€22M Off-Market Pipeline Generated Through Multi-Segment Outbound

Bee Property Development partnered with Converteer.ai to build a scalable outbound engine for sourcing off-market residential and development assets. In just 3 months, the system generated 197 qualified opportunities and uncovered €22M in total acquisition potential.

Case Study

€22M Off-Market Pipeline Generated Through Multi-Segment Outbound

Bee Property Development partnered with Converteer.ai to build a scalable outbound engine for sourcing off-market residential and development assets. In just 3 months, the system generated 197 qualified opportunities and uncovered €22M in total acquisition potential.

Case Study

€22M Off-Market Pipeline Generated Through Multi-Segment Outbound

Bee Property Development partnered with Converteer.ai to build a scalable outbound engine for sourcing off-market residential and development assets. In just 3 months, the system generated 197 qualified opportunities and uncovered €22M in total acquisition potential.

Case Study

€22M Off-Market Pipeline Generated Through Multi-Segment Outbound

Bee Property Development partnered with Converteer.ai to build a scalable outbound engine for sourcing off-market residential and development assets. In just 3 months, the system generated 197 qualified opportunities and uncovered €22M in total acquisition potential.

The Challenge

Bee Property Development was previously dependent on:

Brokers

Personal networks

Inconsistent referral channels

Limited visibility into pre-market or distressed assets

These constraints made deal flow unpredictable and restricted access to high-value opportunities before they reached the open market.

Bee Property Development needed:

A repeatable sourcing engine

Consistent deal flow from multiple professional categories

Access to off-market and pre-market assets

A system that operated independently from broker networks

Data-driven qualification for acquisition readiness

Outbound was selected because it could reach the professionals who hear about properties first.

The Challenge

Bee Property Development was previously dependent on:

Brokers

Personal networks

Inconsistent referral channels

Limited visibility into pre-market or distressed assets

These constraints made deal flow unpredictable and restricted access to high-value opportunities before they reached the open market.

Bee Property Development needed:

A repeatable sourcing engine

Consistent deal flow from multiple professional categories

Access to off-market and pre-market assets

A system that operated independently from broker networks

Data-driven qualification for acquisition readiness

Outbound was selected because it could reach the professionals who hear about properties first.

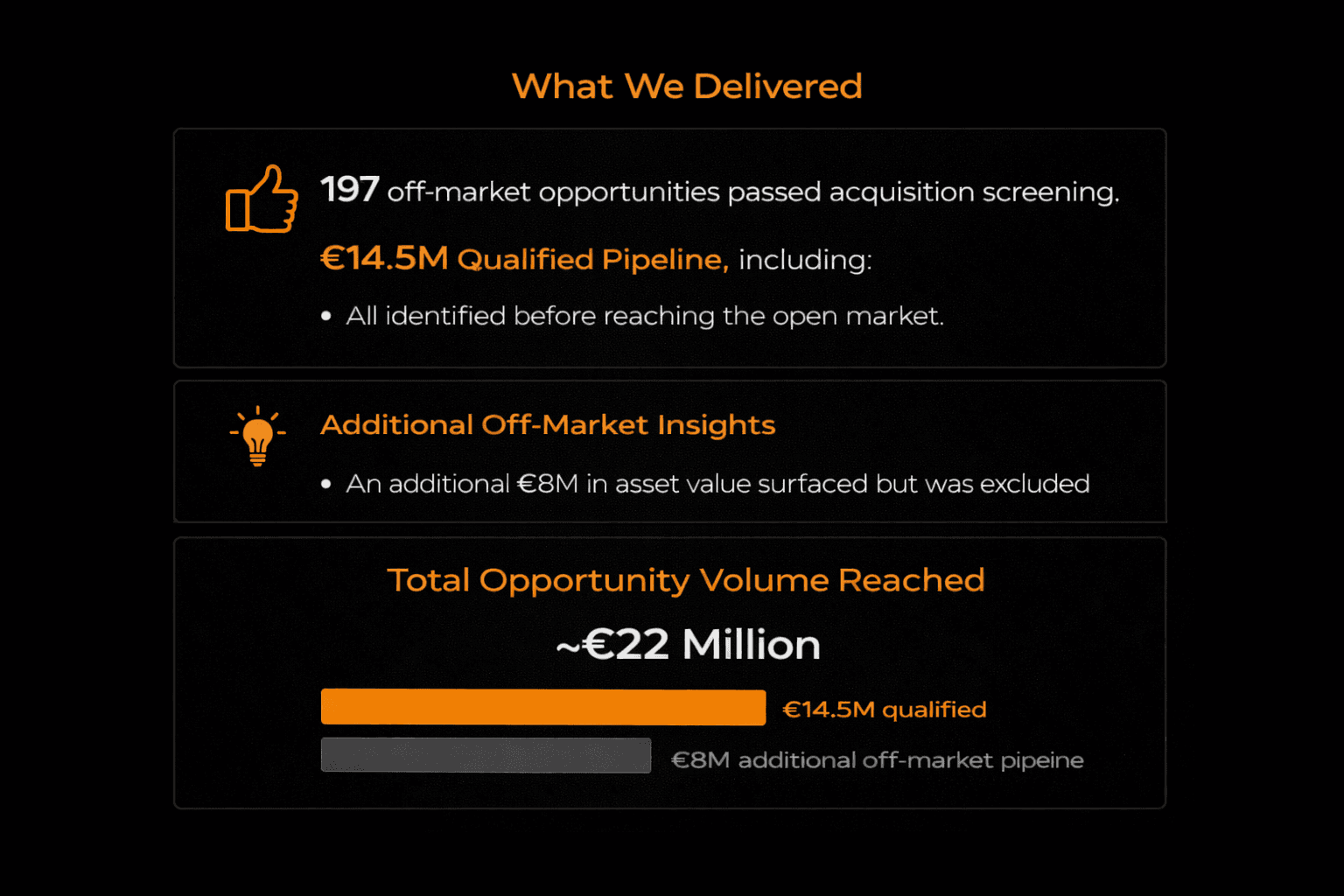

What We Delivered

197 off-market opportunities passed acquisition screening.

€14.5M Qualified Pipeline, including:

Single-unit residential assets (€280K–€400K)

6-unit development package (~€300K)

22-unit residential portfolio (~€1.32M)

Institutional-grade mixed-use/development asset (~€12M)

All identified before reaching the open market.

Additional Off-Market Insights

An additional €8M in asset value surfaced but was excluded due to:

Zoning misalignment

Insufficient yield

Incomplete documentation

Out-of-scope asset types

Total Opportunity Volume Reached

~€22 Million

€14.5M qualified

€8M additional off-market pipeline

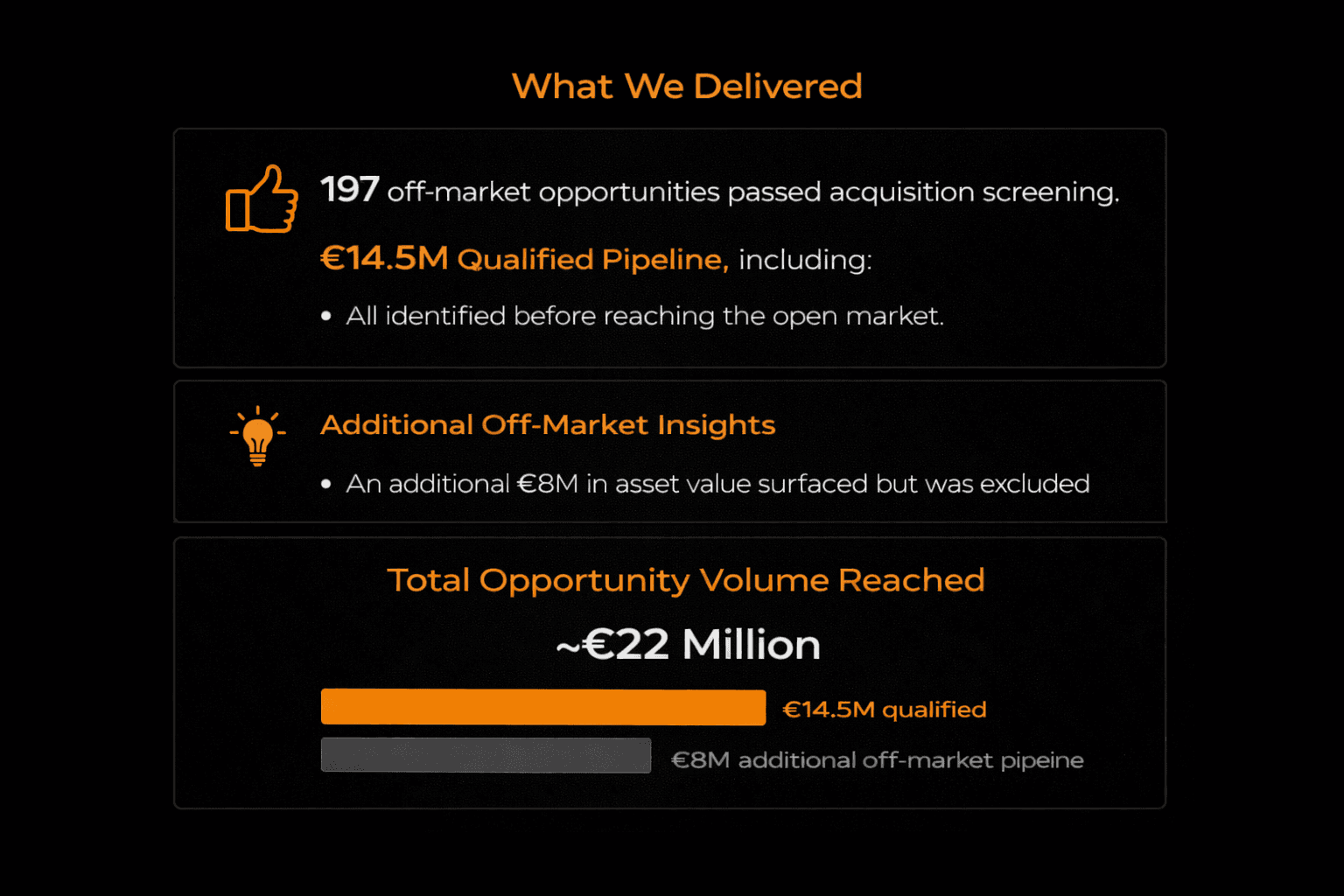

What We Delivered

197 off-market opportunities passed acquisition screening.

€14.5M Qualified Pipeline, including:

Single-unit residential assets (€280K–€400K)

6-unit development package (~€300K)

22-unit residential portfolio (~€1.32M)

Institutional-grade mixed-use/development asset (~€12M)

All identified before reaching the open market.

Additional Off-Market Insights

An additional €8M in asset value surfaced but was excluded due to:

Zoning misalignment

Insufficient yield

Incomplete documentation

Out-of-scope asset types

Total Opportunity Volume Reached

~€22 Million

€14.5M qualified

€8M additional off-market pipeline

Strategic Impact

The outbound system provided visibility typically reserved for:

Banks

Distress managers

Large institutional buyers

A Repeatable, Predictable Acquisition Engine

Deal flow became:

Consistent

Measurable

Independent from brokers

Scalable across cities and asset types

First-Mover Advantage in Negotiations

Bee Property Development gained:

Early discovery

Pre-market pricing clarity

Direct seller access

Lower acquisition competition

Lower Cost-Per-Acquisition Channel

Outbound opened supply channels previously inaccessible without high brokerage fees.

The outbound system provided visibility typically reserved for:

Banks

Distress managers

Large institutional buyers

A Repeatable, Predictable Acquisition Engine

Deal flow became:

Consistent

Measurable

Independent from brokers

Scalable across cities and asset types

First-Mover Advantage in Negotiations

Bee Property Development gained:

Early discovery

Pre-market pricing clarity

Direct seller access

Lower acquisition competition

Lower Cost-Per-Acquisition Channel

Outbound opened supply channels previously inaccessible without high brokerage fees.

The Challenge

Bee Property Development was previously dependent on:

Brokers

Personal networks

Inconsistent referral channels

Limited visibility into pre-market or distressed assets

These constraints made deal flow unpredictable and restricted access to high-value opportunities before they reached the open market.

Bee Property Development needed:

A repeatable sourcing engine

Consistent deal flow from multiple professional categories

Access to off-market and pre-market assets

A system that operated independently from broker networks

Data-driven qualification for acquisition readiness

Outbound was selected because it could reach the professionals who hear about properties first.

What We Delivered

197 off-market opportunities passed acquisition screening.

€14.5M Qualified Pipeline, including:

Single-unit residential assets (€280K–€400K)

6-unit development package (~€300K)

22-unit residential portfolio (~€1.32M)

Institutional-grade mixed-use/development asset (~€12M)

All identified before reaching the open market.

Additional Off-Market Insights

An additional €8M in asset value surfaced but was excluded due to:

Zoning misalignment

Insufficient yield

Incomplete documentation

Out-of-scope asset types

Total Opportunity Volume Reached

~€22 Million

€14.5M qualified

€8M additional off-market pipeline

Strategic Impact

The outbound system provided visibility typically reserved for:

Banks

Distress managers

Large institutional buyers

A Repeatable, Predictable Acquisition Engine

Deal flow became:

Consistent

Measurable

Independent from brokers

Scalable across cities and asset types

First-Mover Advantage in Negotiations

Bee Property Development gained:

Early discovery

Pre-market pricing clarity

Direct seller access

Lower acquisition competition

Lower Cost-Per-Acquisition Channel

Outbound opened supply channels previously inaccessible without high brokerage fees.

Other cases

Other case studies

View our other project case studies with detailed explanations